Your real wealth is invisible, not on social media handles

If you are spending merely to show off your riches on social media handles or to make people jealous, you are undermining the actual process of wealth creation. The real success, i.e becoming wealthy, lies in silently building assets such as savings and investments. Resisting the urge to impress others with flashy spending is a powerful financial habit not many have. In Housel’s words, “Spending money to show people how much money you have is the fastest way to have less money.”

Want to be wealthy? Save money without a reason

Dont look for any specific reason to save. When you build a habit of saving money without any specific goal, you have immense flexibility and financial security to deal with any unexpected situations or curveballs that life might throw at you. As Housel says, “Savings without a spending goal gives you options and flexibility, the ability to wait and the opportunity to pounce.”

Never underestimate the power of compounding

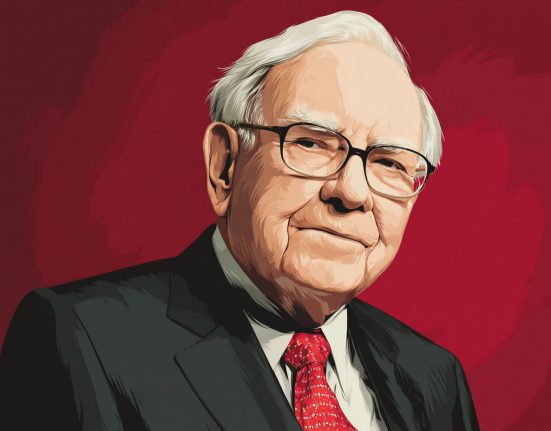

It is no surprise that experts have, time and again, referred to compounding as the 8th wonder of the world. Time is the most important factor when it comes to growing your wealth. It is the time you spend in markets, and not in timing your investments, that makes you rich in the long run. According to Housel, “$81.5 billion of Warren Buffett’s $84.5 billion net worth came after his 65th birthday. His skill is investing, but his secret is time.”

Know the difference between getting wealthy and staying wealthy

Hard work and an aggressive approach, both in career and investing, might help you build solid wealth in the short run, but conservative, sensible spending and frugality it what help you preserve it in the long run, keeping you wealthy, and sustaining your wealth for long. Managing risks and avoiding ruin are key to long-term success. As Housel notes, “Getting money requires taking risks, being optimistic, and putting yourself out there. But keeping money requires the opposite of taking risks.”

Be reasonable with your finances, rather than being technically correct

Let’s face it-at the end of the day, we are emotional, not robotic. Your personal finance decisions should not be based on a formula, but rather on your lifestyle. Be reasonable about your personal finance decisions depending on your lifestyle, but do not chase technical perfection in this regard. Says Morgan Housel, “Do not aim to be coldly rational when making financial decisions. Aim to be pretty reasonable.”

The biggest financial superpower is being content

Did you know that saying enough is the hardest financial skill to master? Knowing when to stop and being content with what you have is the biggest personal finance skill you can master. Knowing “enough” is the ultimate money habit you can develop. “There is no reason to risk what you have and need for what you don’t have and don’t need”, says Housel.